nassau county tax grievance lawyers

Web No other tax grievance firm is run by an attorney who previously served as both Nassau Countys Board of Assessors and as a member of the Assessment Review Commission. Web At the request of Nassau County Executive Bruce A.

Cover Nl 09 06 Qxd Nassau County Bar Association

Web Tax Grievance Form.

. Mail to Town of Brookhaven Assessor 1 Independence Hill Farmingville NY 11738 Attention. Web How it Works. For further information contact.

Get local legal help for your Property Tax issues. PAY MY BILL GET STARTED. Deadline for filing Form RP.

Web E-mail to assessor-grievancebrookhavennygov. New York City Tax Commission. Web Nassau County NY Tax Law Lawyer with 39 years of experience.

Web Residential Tax Grievance. Web Hiring Maidenbaum to file a Nassau County tax grievance on your behalf is quick and easy. Contact the experienced attorneys at The Gold Law Firm today.

Web Is there a fee to file a grievance with arc. Web New York City residents. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Click to request a tax grievance authorization form now. Nassau County Assessment Review Commission. Web No one is under an obligation to use an attorney to file a Nassau County Tax Grievance however if you want my firm to do it we will AND we will NOT charge.

Property tax grievance is a formal complaint filed. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. 11 Broadway Suite 1155 New York NY 10004.

Goldburd McCone LLP assists clients in the Nassau County New. You may file an online appeal for any type of property including commercial property and any. Web The tax grievance asks the local taxing authority - the County in Nassau - to reduce the assessment on which your property tax is based.

Drop off in the bin. Web If your money has been misappropriated in the practice of law you may be eligible for reimbursement from the Lawyers Fund. 212 233-0580 403B CENTRAL AVENUE.

Our main objective is to minimize our clients property tax assessment with personalized service. We set the record for tax reductions. Web We are one of the leaders in property tax challenges on Long Island.

Tax and Real Estate. Web Between January 3 2022 and March 1 2022 you may appeal online. 29185 in Suffolk County.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23. If youve already received a marketing piece from us you can simply access your. Web Appeal your property taxes.

73443 in Nassau County.

Tax Certiorari Condemnation Mccarthy Fingar Llp

How To Appeal Your Property Tax Assessment Village Of Upper Brookville

Property Tax Grievance Attorney Long Island Patsis Law New York

News Flash Nassau County Ny Civicengage

Just Another Day At The Office American Civil Liberties Union

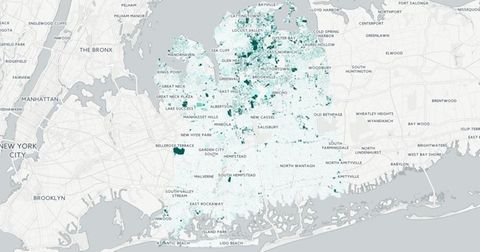

Nassau County S Property Tax Game The Winners And Losers

:quality(70)/d1hfln2sfez66z.cloudfront.net/03-16-2022/t_9033ea57baaa47e38c18606850a71aaf_name_file_960x540_1200_v3_1_.jpg)

Nassau County Attorney Mike Mullin To Resign After State Investigation Action News Jax

Find Top Nassau County Ny Property Tax Lawyers Near You Lawinfo Attorney Directory

Nassau County S Tax Assessment Dilemma The High Court Invalidates Local Law Bond Schoeneck King Pllc Jdsupra

Nassau County Tax Lawyers Compare Top Rated New York Attorneys Justia

How To Stop Property Tax Foreclosure In New York

Community Service Wisselman Harounian Associates

Attorney Good Faith Adr Certfication 22 Nycrr Section 202 11 Pdf Fpdf Docx New York

Tax Certiorari Petition February 09 2018 Trellis

Insurance Commercial Litigation Law The Gold Law Firm Pc

Tenny Takes Final Stab At Property Tax Reform Via Lawsuit

Top Lawyers 9 15 2022 By Richner Communications Inc Issuu

How To File A Tax Assessment Grievance In Nassau County Hilary Topper Blog